A classic feature in venture debt deals are warrants. Warrants are a security that gives the holder the right (but not the obligation) to purchase company stock at a specified price within a specific period of time. These are issued by the company.

The guaranteed price at which the warrant holder has the right to buy the stock at is often called the strike price or exercise price. However, this price is only valid for a finite time period, during which the warrant can be exercised. Expiration dates can range anywhere from 1-15 years.

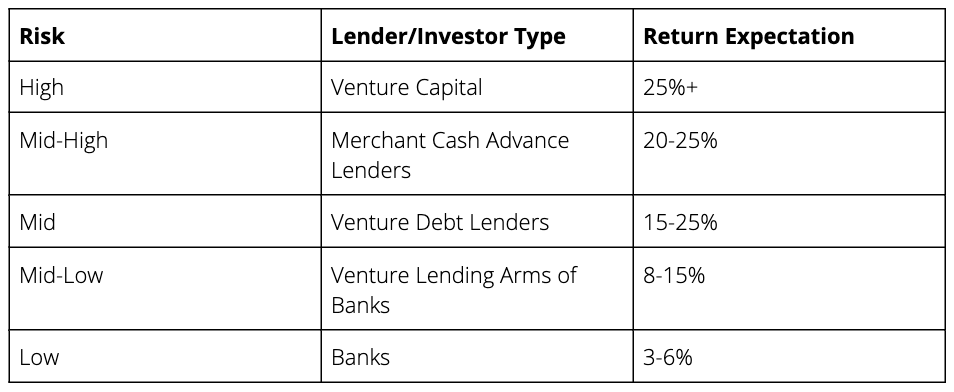

As with any investment, investors are looking to gain a fair level of return that aligns with the level of risk they are taking. Let’s take a look at different types of funding and the risk/return associated with each.

Banks

Starting from the bottom, banks are at the lowest end of the risk/return spectrum. This is because banks invest in deals that are perceived as “less risky.” Deals with lower risk include companies that are larger in size, are generating more revenue, are likely profitable, and have higher asset-backed coverage. Banks also include strict financial covenants which help ensure companies are meeting strict requirements such as debt to EBITDA ratios, interest service, and coverage ratios. As a result of this lower risk, banks are able to offer lower interest rates and no warrants.

Venture Debt

At the midpoint, we see venture debt lenders who provide capital to high-growth companies looking to scale up their operations. These companies tend to be higher risk because while they have established a product-market fit and are generating revenue, they are likely not yet profitable and may even lack hard assets (especially if it is a technology or SaaS-based business). As a result of this risk, venture debt lenders require higher interest rates compared to banks and warrants.

Venture Captial

At the highest end of the risk/return spectrum we find venture capital. These investors see the highest risk deals because they fund companies that are very early stage. Instead of seeking repayment through interest payments, venture capital investors take a portion of equity with the ultimate goal of getting the company acquired or to go public.